It is mandatory for a real estate investor to conduct a market analysis before investing in real estate. Market analysis is conducted to understand whether a particular project is viable or not. When the demand for the property increases, the value of the property also increases.

Doing market research and then investing in the property enables the investor to stand out in the competition. It will also enable the investor to reap profits in the long run. Market analysis also helps in evaluating the real value of the property by increasing the feasibility of investment.

What is Real Estate Market Analysis?

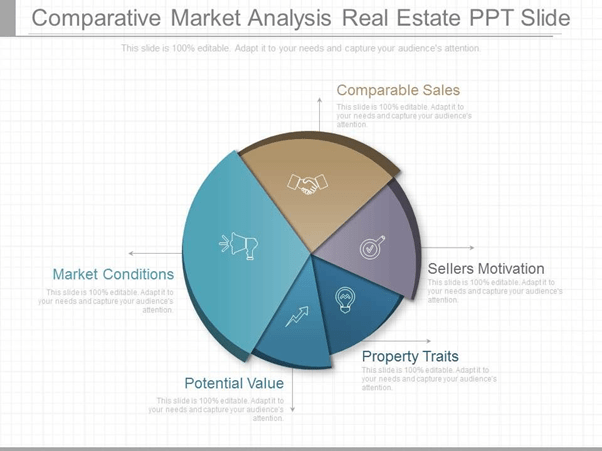

Before buying or selling a property a real estate investor should conduct a market analysis. A real estate market analysis is also known as comparative market analysis. The purpose of real estate market analysis is to analyse the market value of the properties and also to compare the market price of different properties.

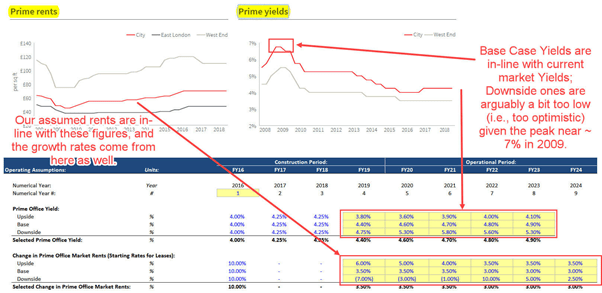

The changing economic conditions and the fluctuations in the demand and supply influence the market price of the property. By conducting a real estate market analysis an investor is updated with the changing price. It is the responsibility of a real estate agent and brokers to create a report to help sellers in setting list price for their homes and also to help buyers make competitive offers.

The information gathered through real estate market surveys help both the buyers as well as sellers. The comparative analysis or real estate market analysis makes sure both the sellers and buyers are getting a fair deal for the property.

Why to Conduct a Real Estate Market Analysis

The main reason for conducting a real estate market analysis is to have the information which acts as a guide for both the buyer and seller in investing in the properties safely. The other reasons for conducting a real estate market analysis are:

- To identify the value of investment projects in different areas.

- To have an understanding of the projects which will have a developmental value which in turn will increase the value of the properties in future.

- To know which city has more opportunities for investment.

- To know the demographic aspect that influences the investment and its value.

- To identify the elements that have an impact over the investment in certain places.

This analysis helps an investor in reducing the chance of overpaying for the property and for the sellers to get a good deal.

Tips for Conducting an Effective Real Estate Market Analysis

Before investing in a property, an investor must know about the type of market, its products or services offered etc. Here are some essential points to consider while conducting a real estate market analysis

● Property analysis

The investor has to perform an analysis of the property. The area of the property, neighbourhood, services provided etc has to be analyzed. These factors influence the value of the property by increasing the demand for the property.

● Evaluation of the original price

Once the process of property analysis is done, the next step is to research the original listing of the property. By doing this an overall overview of the property could be analysed. We can also review the photos and descriptions of the property from the Internet.

● Verifying the property value

By using online resources we can estimate market value of the property. Since it is an estimated market value, the chances of the value being accurate is less. But by doing this it will help an investor in the process of research. It will also contribute towards the research by giving useful insights.

● Comparisons

Comparing different properties in the same area with the same aspects will help an investor to determine the value of the property. This allows an investor to understand if the property is overvalued or undervalued.

● Decide the market value

By doing all the research an investor gets an overview of different price ranges for the property. Analyze all the factors and elements which influence the value of the property. By doing so an investor can decide whether or not to buy that particular property.

Steps to Conduct a Real Estate Market Analysis

It is easy to conduct a market analysis, when the market is divided into different segments such as market, demand, supply and environment.

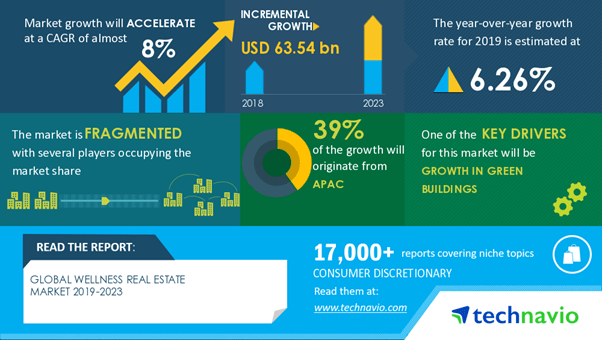

Step 1: Understanding the market

The first step is to understand the market from a global perspective. An investor must have a clear knowledge about the market volume, trends etc. By doing market research an investor will be able to understand the turnover of the particular market, its customers and about the quality etc.

Terms and conditions for sale of property, different ranges in which properties are sold or bought and about the potential suppliers etc can be identified just by doing a real estate market analysis.

Step 2: Demand analysis

The next step is to analyze the demand in a particular market. By analyzing the demand an investor can identify whether the market has a potential for growth or not. Higher the demand higher will be the price of the property. When we analyze the demand in a market, it enables the investor to have an idea of customers choice, consumption rate etc.

Step 3: Offer analysis

In the process of offer analysis, an investor must compare different offers provided by the real estate agent as well as the competitors. By doing this it enables the investor to be aware of different competitors in the market, their offering prices and the companies having the largest market share. This helps an investor to find a good competitive deal which exists in the market and also helps agents to offer a good deal to its customers.

Step 4: Study of environmental factors

In the study of the environment, it consists of analyzing different environmental factors that influence the real estate market

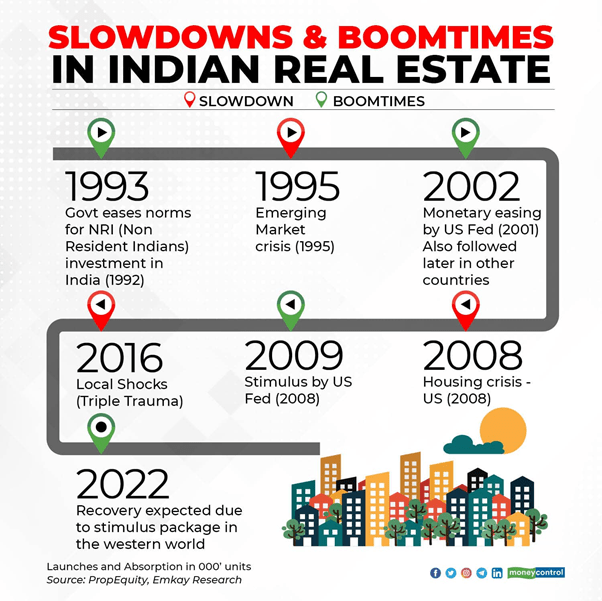

. The factors such as government laws, technological development, interest rates etc influence the real estate market prices. For eg: If a place is about to be developed technologically, the price of the properties around that area will have a higher price than areas that don’t have any development.

Step 5: Data collection

In real estate market research, data collection is the most important step. This process of data collection enables the investor to have an overview about whether an investment is viable or not. Nowadays there are many online applications which help investors in the process of data collection.

Step 6: Results reporting process

Once all the above process is completed, this final step with all the information obtained will allow the investors to perform the analysis. In this process an investor decides whether or not to proceed with the investment. It also helps investors to develop strategies to secure the investment.

The Bottomline

Real estate market analysis is an important step an investor must go through before investing in a property. It gives an investor the overview of whether the property is undervalued or overvalued. It also helps an investor to identify the different elements and factors that influence the market value of the property. Maction can help you gear your market research efforts for your real estate business. To know more, book a call today.